The Blincoe Blog

We write in plain English - no jargon, no waffle - just useful ideas to help you take control of your money, plan ahead, and make smarter decisions.

🔍 Looking for something specific? Use the search tool below.

“An investment in knowledge always pays the best interest.”

- Benjamin Franklin

VCTs in 2026: Rule Changes, Tax Relief Cuts and What the Real Performance Numbers Show

VCTs are back in the spotlight ahead of rule changes in 2026/27. We recap the tax benefits, risks and what recent performance really shows.

Investment Bonds Part 1: How They Work, Tax Deferral, and Using Bonds for Retirement Planning

Investment bonds can offer valuable tax deferral once ISA and pension allowances are used. Our first blog, in a series of three, explains the basics and retirement use case.

2026 Market Outlook: Why Forecasts Are Unreliable and Staying Invested Still Wins Over Time

As 2026 begins, market mood has flipped from fear to optimism. But history shows the best strategy is simple: ignore the noise and stay invested.

Twelve Charts of Christmas: A Review of Global Markets in 2025 and the Investment Outlook Ahead

Through twelve charts of Christmas, we look back on a strong year for investors and revisit the core principles guiding long-term investment success.

Bubble Talk Returns: What It Means for Investors in 2025

In this week's blog, we explore why bubble talk is back and, more importantly, what you should do about it.

Where You Hold Your Investments Matters: A Guide to Asset Location

Many investors focus on what to invest in, not where. But your investment ‘wrapper’ can be just as important for long-term growth

US Equities: Dystopia, Utopia, or Something in Between?

Most portfolios hold around 50% US equities. Some see this as too much, others too little. We explore both sides of the debate.

Why No Portfolio Is Truly Passive: The Active Decisions Behind Passive Investing

Passive investing sounds simple, but when you’re managing a whole portfolio, every decision is active. In reality, no portfolio is truly passive.

Markets Keep Climbing — Why Investors Should Stay Grounded

It's been a truly extraordinary run for global stock markets. Here is why investors should stay optimistic, but realistic about what comes next.

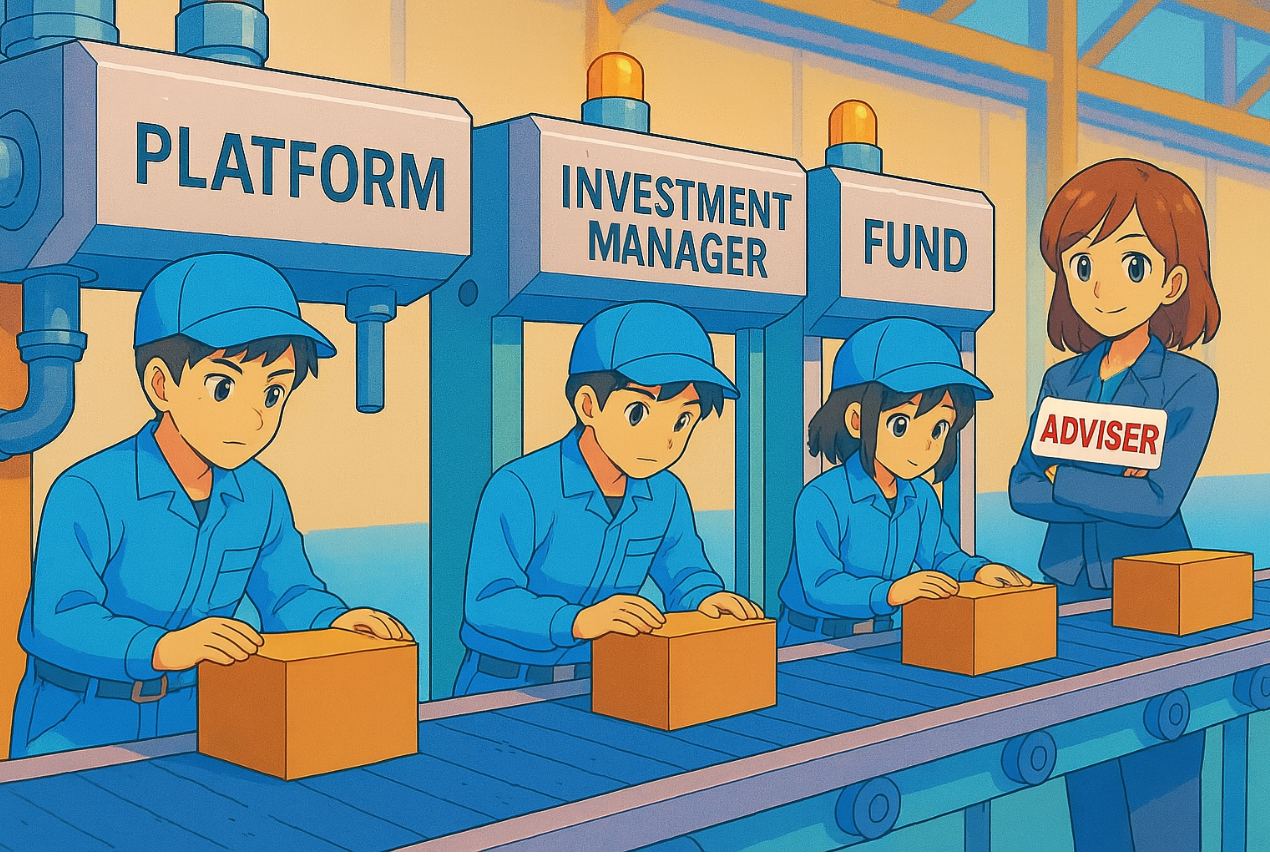

Who Really Holds Your Investments? Understanding the 4 Layers of Protection When Investing Through an Adviser

When you invest through a financial adviser, there are several different parties involved in the management of your investments. Each plays a crucial and unique role. Many investors worry: "What happens to my money if one of these companies fails?" It's a valid concern, and one that UK financial regulations address through robust protection mechanisms.

What Recent Market Volatility in 2025 Teaches Us About Risk Tolerance

What a ride! After hitting all-time highs on 19th February, the market plunged nearly 19% in six weeks, only to recover swiftly not long afterwards. A bear market scare and a bull market bounce, all within a single quarter.

Are Venture Capital Trusts Worth It? Performance vs Tax Relief

We’ve previously explored the mechanics of VCT investing – the rules, the risks, and the generous tax perks, but we’re returning to the topic this week. The key question we ask is: Is VCT investing still worth considering?

Should You Pay Off Your Mortgage or Invest? Pros and Cons Explained

This is a question that comes up frequently: If you have some spare cash, should you use it to pay off your mortgage or invest it for future growth?

How to Stay Calm (and Invested) When Markets Get Scary

Global financial markets have suffered a bruising few weeks. At the time of writing, the US benchmark S&P 500 index has fallen 8% year-to-date and stands 12% below its all-time high achieved just seven weeks ago(!!).

Why Market Volatility Is Back — and What Investors Should Do About It

It’s been a volatile few weeks on the stock market, driven by concerns over a potential trade war and signs of a slowdown in the US economy.

Factor-Based Investing Explained: The Smart Middle Ground Between Active and Passive

Investing is typically framed as a choice between two approaches: active or passive. But what if there was a middle ground that could potentially offer the best of both worlds?

Why the US Dominates Global Markets—and What UK Investors Should Watch

Since 2011, the US market has grown by over 20%, now making up two-thirds of global equities.

Investment Lessons from 2024 and What They Mean for 2025

Nine charts tell the story of an extraordinary year in financial markets and some insights for the period ahead.

What Real Investment Risk Looks Like — And Why Volatility Isn’t It

Successful investing isn’t about avoiding risk entirely. It’s about understanding the different types of risk, accepting them, and managing them wisely to achieve your financial goals.

Should You Invest Only in the US Stock Market? Why Diversification Still Matters

Is doubling down on US equities, at the expense of global diversification, a good strategy? We think not.