US Equities: Dystopia, Utopia, or Something in Between?

The case for (and against) US equities

A recurring theme in client conversations is the proportion of US equities within their investment portfolios.

Most portfolios have around 50–55% allocated to US equities—an objectively high figure, though still slightly underweight compared to the US share of global stock markets, which stands at 63–64% (per the MSCI All Cap World Index, which includes large, mid, small and micro-cap stocks across developed and emerging markets).

Some say that’s too much exposure to one region. Others argue it’s not nearly enough. In this week’s blog, we explore both sides of the transatlantic tug-of-war.

Please note, when investing, your capital is at risk. The value of your investment (and any income from them) can go down as well as up, and you may get back less than you invested. Neither simulated nor actual past performance is a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

The Dystopian Case: A Red Dwarf Moment?

There are certainly reasons for caution (though, let’s face it, there always are).

As one client recently put it, “The US feels like it’s approaching its ‘Red Dwarf moment’—yesterday’s bright star, now starting to fade.”

The valuation story is front and centre, i.e. that US equities are ‘priced for perfection’. The Shiller PE ratio—essentially a ten-year smoothed measure of stock prices versus earnings—currently hovers around 40. That’s more than double its long-term average of 16 [source: mulpl.com].

Whenever valuations have looked this stretched, trouble hasn’t been far behind. Think 1929, just before the Great Depression, and the early-2000s, just before the dot-com boom (and ultimate bust).

Beyond valuations, there’s the increasingly precarious structure of market concentration. Nvidia—now the world’s largest company at over $4 trillion—is reportedly eyeing a stake in OpenAI, the world’s most valuable private company. OpenAI is partly owned by Microsoft, the second most valuable public company. And, of course, OpenAI’s technology relies on chips supplied by… Nvidia. It's a corporate equivalent of a house of cards.

And then there’s the fiscal picture. The US deficit continues to balloon, suggesting a country living beyond its means.

The Utopian Counter-Argument: Global Dominance Continues

But there’s also a compelling case to be made in favour of continued US equity dominance.

1. Earnings Momentum

The earnings growth of the dominant US tech firms has been nothing short of exceptional—posing a strong counter to comparisons with the early-2000s tech bubble.

Back then, the top seven US stocks were trading at 52x earnings, with minimal cash and modest profit margins. Today’s Magnificent Seven trade on a more measured 24x, with cash reserves of 4.2% and profit margins averaging 28% [source: Datastream, FactSet, Goldman Sachs, via Timeline].

Valuations remain high—but this time, there’s far more substance behind the numbers.

2. Pricing Power

The US has a debt problem—though it’s not alone. At mid-year, public debt hit $36.2 trillion (119% of GDP), with interest costs nearing $1 trillion—now the government’s third-largest expense.

Broadly speaking, there are four main ways out of this:

Raise taxes

Cut spending

Stimulate growth through deregulation

Let inflation quietly reduce the real value of debt

The first two are politically unpalatable in a populist era. The third—deregulation—appears to be gathering pace under Trump’s second term, but takes time to filter through. That leaves the fourth—run inflation modestly above target—as the most likely route.

So what does this mean for equities? In an environment of elevated growth and inflation, pricing power is king. Many would argue that the US giants—cash-rich, lightly leveraged, and globally dominant—are well placed to protect margins and weather any interest rate rise.

3. American Companies, Worldwide Profits

Perhaps the strongest argument in favour of a seemingly high US equity weighting is that the label itself is misleading. Many of these businesses may be domiciled in the US, but their revenue streams are anything but domestic.

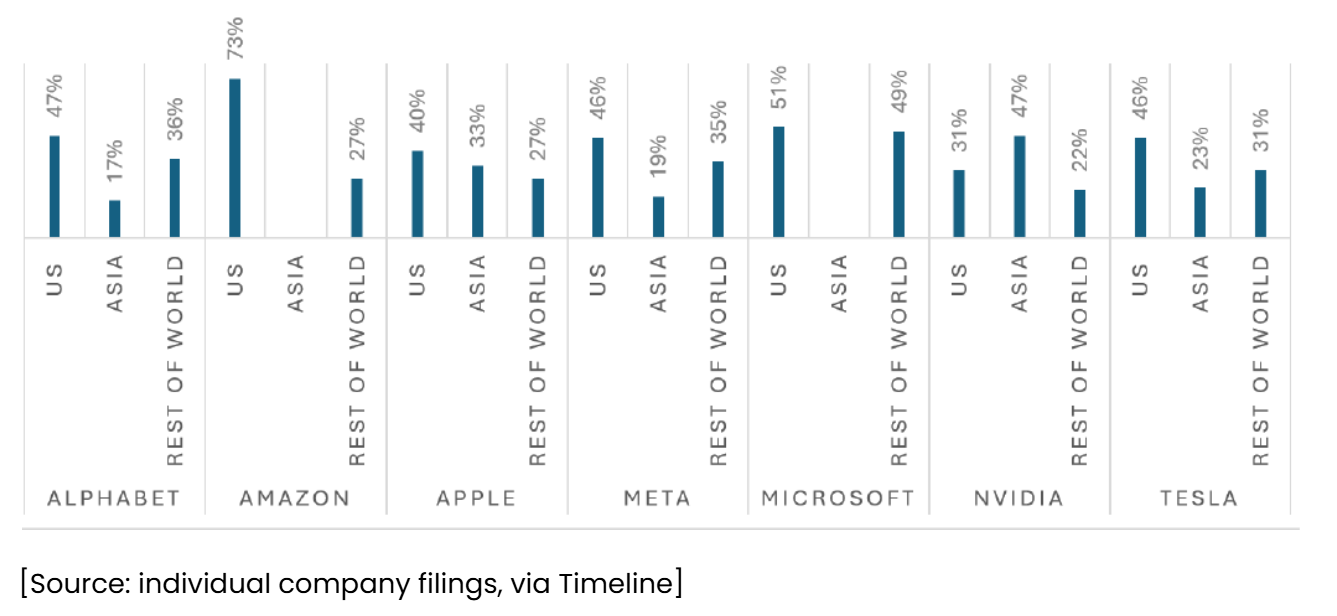

The chart below shows the revenue breakdown for the Magnificent Seven tech giants, based on their own filings. Most generate 50–60% of their income from outside the US.

These are global businesses in all but postcode—providing exposure not just to the US economy, but to global consumer trends and growth across both developed and emerging markets.

4. AI-Boom

Finally, the most widely cited reason to stay invested: we may be at the start of an AI-fuelled productivity revolution—one with the potential to transform entire industries.

It’s hard to predict which companies will come out on top. But given their scale, resources and current momentum, betting against the US tech giants feels like a bold call.

Our Approach: Let Markets Do Their Thing

We’re comfortable with the current position—just over half of equity exposure in US companies, slightly underweight versus the MSCI All-Country World Index.

This isn’t a bet on US outperformance or underperformance. In truth, no one can predict that reliably—though plenty will say they did (after the fact).

Instead, we follow a rules-based, globally diversified approach. Portfolios adjust naturally as markets reallocate towards regions offering stronger returns.

The chart below shows how global market leadership has shifted over time.

As you can see, US dominance isn’t new—it was even greater in the late 1960s. Other regions (Japan in the ’80s) have had their turn. Portfolios that follow the market rise with them - since 1925, global equities have delivered around 10% annual returns in nominal terms, or 5–6% after inflation. As long as the global economy continues expanding—powered by innovation and corporate ambition—we believe markets will continue to trend upwards over time.

Conclusion: Neither Dystopia Nor Utopia

The truth about US equities likely sits somewhere between extreme caution and blind optimism. Yes, there are challenges—high valuations, fiscal pressure, concentration risk. But US companies also boast world-leading profitability, pricing power and global reach.

Rather than trying to time allocation shifts or outguess the market, we stick to a disciplined strategy. If US dominance fades, our portfolios will adjust. If it persists, our clients will continue to benefit.

Happy Thursday!

Kind regards,

George

Referrals Welcome

Our business grows mainly through personal recommendations. If you know someone—whether a friend, family member or colleague—who might benefit from financial planning, we’d be grateful if you could share my details with them. Alternatively, you can pass their details on to me, and I’ll be happy to reach out.

Regulatory Information

Blincoe Financial Planning Limited is an appointed representative of Sense Network Ltd, which is authorised and regulated by the Financial Conduct Authority. Registered in England & Wales (No. 14569306). Registered Office: Star Lodge, Montpellier Drive, Cheltenham, GL50 1TY.

Important Disclaimer

This blog is for general information only and is intended for retail clients. It does not constitute financial or tax advice, nor is it an offer to buy or sell any specific investment. Since I don’t know your personal financial situation, you should not rely on this content as tailored advice. While we aim to provide accurate and up-to-date information, we cannot guarantee that all details remain correct over time. We are not responsible for any losses resulting from actions taken based on this blog’s content.