Tax Efficiency Hub

Paying more tax than you need to? These articles will help you keep more of what you earn and grow.

Key Topics Covered:

Offshore bonds, BR and tax wrappers

Strategic gifting

Capital gains vs savings income

Bed & ISA and Bed & Pension

Budget announcements and changes

Featured Articles

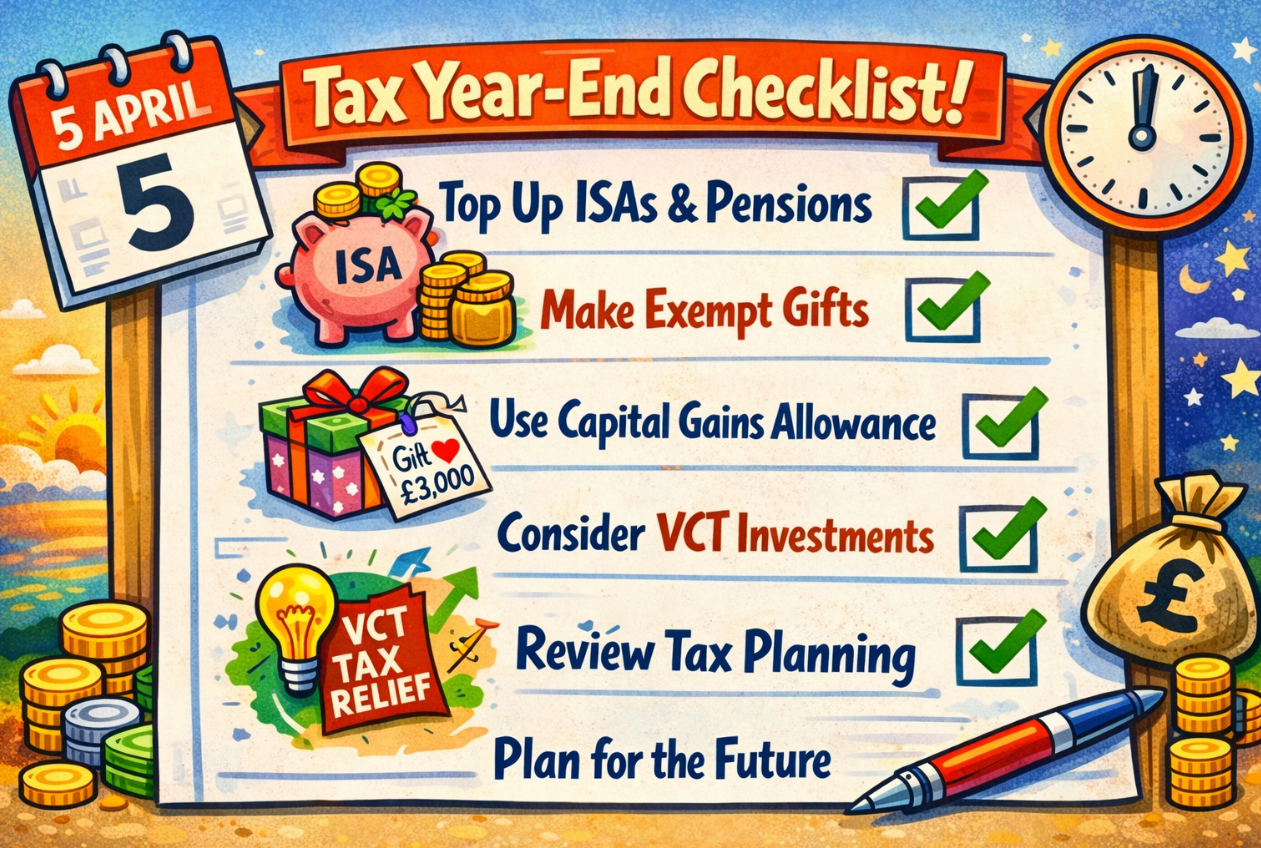

With the tax year ending on 5 April, now is the time to review allowances, use available reliefs, and prepare for significant tax changes ahead.

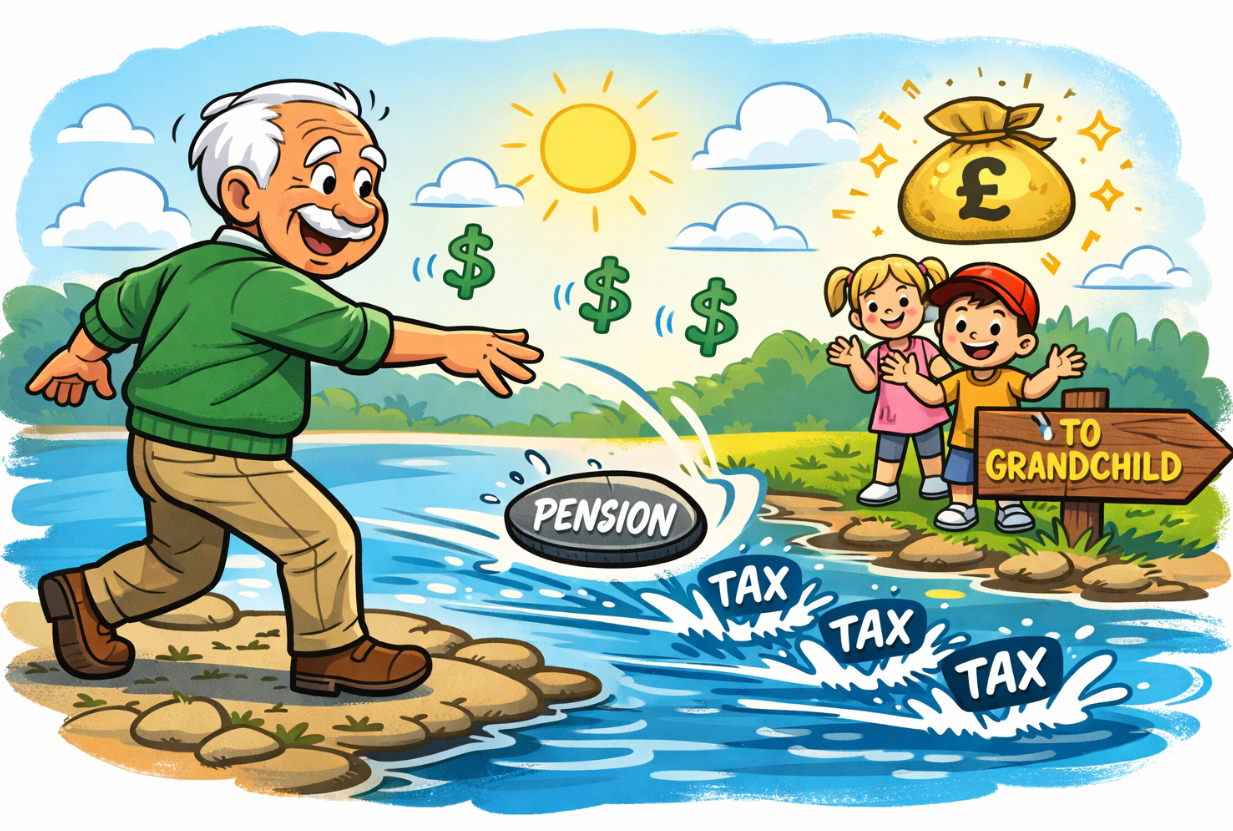

Leaving pension wealth to grandchildren, rather than children, can significantly reduce income tax on inherited pensions - especially once withdrawals become taxable after age 75.

George is running the London Marathon for Sue Ryder! We explore how charitable giving can support a great cause while delivering meaningful tax planning benefits.

ISAs remain one of the most powerful tax-efficient tools for UK savers. This week, we revisit the rules, options, and how to use your allowance effectively.

After months of speculation, the Autumn Statement delivered fewer shocks than expected, but introduced a series of gradual tax changes that will shape planning decisions over the coming years.

Budget rumours are everywhere, but which ones matter? With the Autumn Statement days away, we outline the changes most likely to make the final cut.

Looking to reduce inheritance tax without losing control of your money? A Loan Trust could offer the right balance of access and efficiency.

With the Autumn Statement weeks away, we have played Chancellor for a day — exploring tough but realistic ways to restore stability and strengthen UK finances

Discover how the latest childcare support can save your family thousands, and how smart pension planning can ensure you don't miss out.

This is the third in our trilogy exploring some of the most common pitfalls we encounter in financial planning, today's focus turns to tax. We look at 10 common mistakes and how to avoid costly errors.

The once-popular General Investment Account (GIA) has come under pressure in recent years. While GIAs have lost some shine, they’re far from redundant. For many clients, the ability to blend them with pension contributions to preserve basic rate treatment keeps them firmly in the financial planning toolkit.

The Autumn Statement looms and the usual crystal ball gazing and Westminster whispers have already begun. In this weeks blog we look at what might be coming – rumours, reality, and red herrings.