The Blincoe Blog

We write in plain English - no jargon, no waffle - just useful ideas to help you take control of your money, plan ahead, and make smarter decisions.

🔍 Looking for something specific? Use the search tool below.

“An investment in knowledge always pays the best interest.”

- Benjamin Franklin

VCTs in 2026: Rule Changes, Tax Relief Cuts and What the Real Performance Numbers Show

VCTs are back in the spotlight ahead of rule changes in 2026/27. We recap the tax benefits, risks and what recent performance really shows.

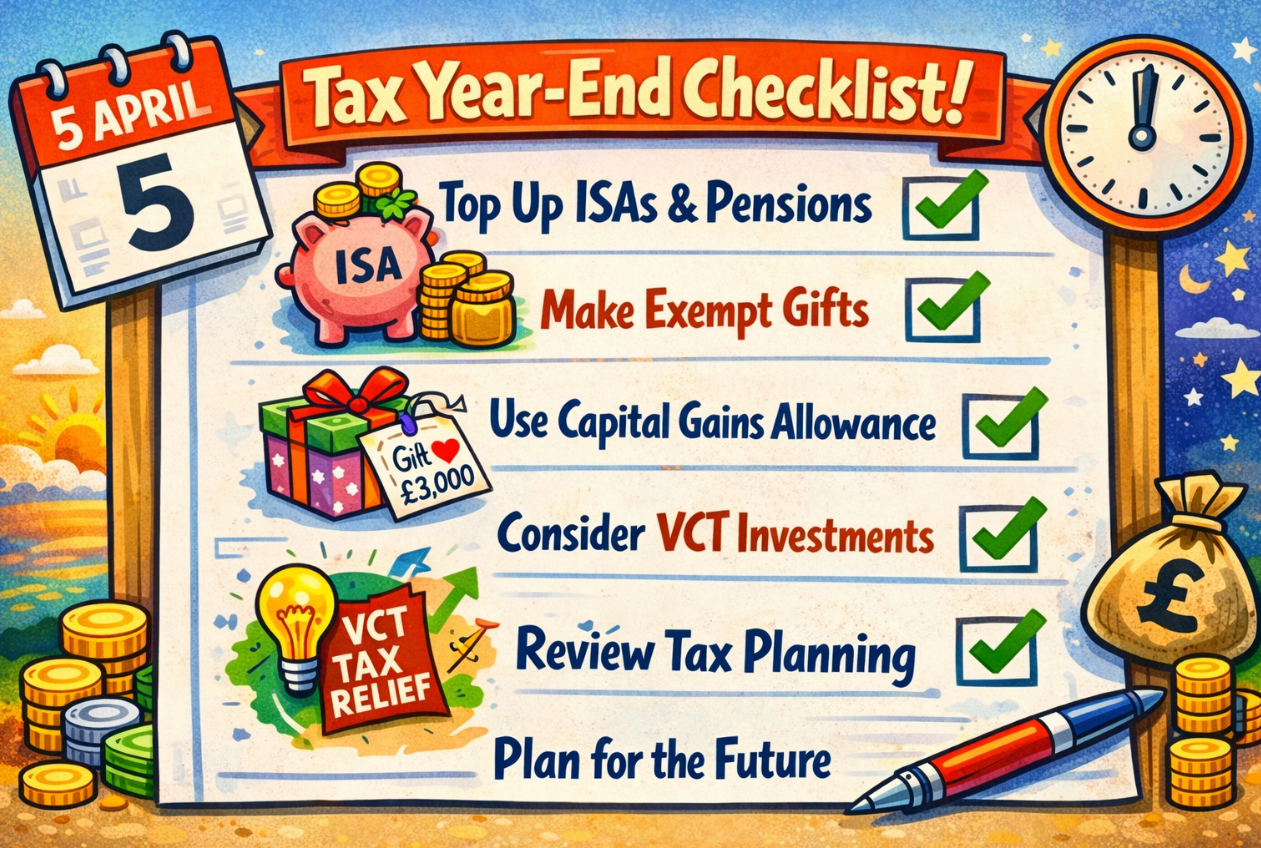

Tax Year-End Planning 2025/26: Five Key Actions Before 5 April and Major Tax Changes From April 2026

With the tax year ending on 5 April, now is the time to review allowances, use available reliefs, and prepare for significant tax changes ahead.

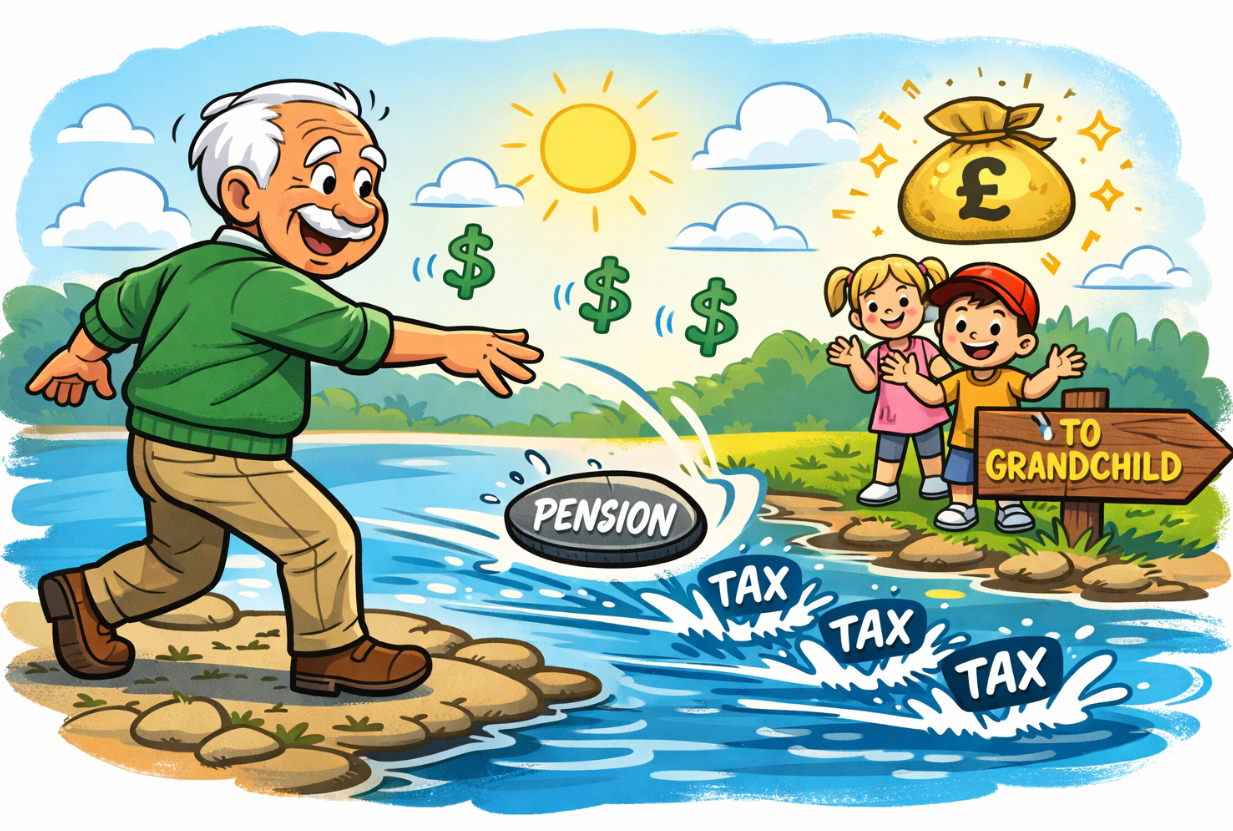

Leaving Your Pension to Grandchildren: How Generation Skipping Can Reduce Tax on Inherited Pensions

Leaving pension wealth to grandchildren, rather than children, can significantly reduce income tax on inherited pensions - especially once withdrawals become taxable after age 75.

Running 26.2 Miles for a Great Cause (and a Good Tax Break)

George is running the London Marathon for Sue Ryder! We explore how charitable giving can support a great cause while delivering meaningful tax planning benefits.

Investment Bonds Part 1: How They Work, Tax Deferral, and Using Bonds for Retirement Planning

Investment bonds can offer valuable tax deferral once ISA and pension allowances are used. Our first blog, in a series of three, explains the basics and retirement use case.

Understanding ISAs in 2026: Types, Rules, Allowances and How to Use Them Tax-Efficiently

ISAs remain one of the most powerful tax-efficient tools for UK savers. This week, we revisit the rules, options, and how to use your allowance effectively.

2026 Market Outlook: Why Forecasts Are Unreliable and Staying Invested Still Wins Over Time

As 2026 begins, market mood has flipped from fear to optimism. But history shows the best strategy is simple: ignore the noise and stay invested.

Twelve Charts of Christmas: A Review of Global Markets in 2025 and the Investment Outlook Ahead

Through twelve charts of Christmas, we look back on a strong year for investors and revisit the core principles guiding long-term investment success.

Why Younger People Are Turning Away from Pensions - And Why the Maths Still Strongly Favour Saving Early

Younger clients are turning away from pensions, but the maths is unchanged: tax relief and decades of compounding still make them unmatched for long-term wealth.

Retirement Spending: Why £5,000 a Month Is a Useful Benchmark - and What Pot You Need to Fund It

Struggling to picture your future spending in retirement? The PLSA’s £5,000-a-month guideline gives a solid starting point for long-term financial planning.

Autumn Statement 2025: Key Tax Changes Announced by Rachel Reeves and What They Mean for Your Financial Planning

After months of speculation, the Autumn Statement delivered fewer shocks than expected, but introduced a series of gradual tax changes that will shape planning decisions over the coming years.

Autumn Statement 2025: Likely Changes to Income Tax, Pensions, CGT, IHT and Property Taxes

Budget rumours are everywhere, but which ones matter? With the Autumn Statement days away, we outline the changes most likely to make the final cut.

How Loan Trusts Work: A Practical Guide to Inheritance Tax Planning With Access to Capital

Looking to reduce inheritance tax without losing control of your money? A Loan Trust could offer the right balance of access and efficiency.

Using Cashflow Modelling To Plan for Inheritance Tax, Without Running Out

In this week's blog, we talk cashflow modelling and estate planning.

Bubble Talk Returns: What It Means for Investors in 2025

In this week's blog, we explore why bubble talk is back and, more importantly, what you should do about it.

If I Were Chancellor for a Day…

With the Autumn Statement weeks away, we have played Chancellor for a day — exploring tough but realistic ways to restore stability and strengthen UK finances

Why Annuities Deserve a Second Look in Today’s Retirement Market

With rates rising and new tax rules ahead, annuities are regaining appeal as a way to secure guaranteed income in retirement.

Where You Hold Your Investments Matters: A Guide to Asset Location

Many investors focus on what to invest in, not where. But your investment ‘wrapper’ can be just as important for long-term growth

US Equities: Dystopia, Utopia, or Something in Between?

Most portfolios hold around 50% US equities. Some see this as too much, others too little. We explore both sides of the debate.

What Happens When You Die Without a Will?

Around 60% of UK adults don’t have a Will, leaving estates distributed by intestacy rules that rarely match personal wishes or modern family dynamics.