2026 Market Outlook: Why Forecasts Are Unreliable and Staying Invested Still Wins Over Time

Why Staying Invested Beats Timing the Market

First and foremost, and on behalf of the team at Blincoe, wishing you a very Happy New Year - here’s to a healthy and successful 2026!

As we turn the page on 2025, it’s striking how much market sentiment seems to have shifted.

Just a few months ago, it seemed like everyone was bracing for a stock market correction:

In October, the FCA’s Andrew Bailey warned that asset valuations may not align with economic and geopolitical risks.

That same month, Jamie Dimon, CEO of JP Morgan, echoed those concerns, suggesting investors were underestimating the chance of a major downturn (though he’s voiced such concerns for several years).

And in December, Michael Burry - best known for predicting the 2008 crash and portrayed by Christian Bale in The Big Short - warned of potentially years of weak returns, pointing to the dominance of passive investing and the lack of valuation support beyond a handful of large-cap tech stocks. This followed the announcement that he was closing his hedge fund, Scion Asset Management.

Yet here we are, a few weeks later, and the mood appears much more buoyant.

A new year often brings a reset in outlook. Instead of fixating on recent price moves, investors seem to be reassessing the underlying fundamentals and finding reasons for optimism.

As the FT put it in a recent piece titled 'Why the melt-up is still on', “casting an eye across the outlooks from all the major investment banks and big asset managers, it is close to impossible to find a naysayer.”

The article cites a cocktail of bullish factors: strong corporate earnings in the US, falling interest rates, normalised inflation (though still above target), the impact of fiscal stimulus via tax rebates (due to hit US consumers’ bank accounts early this year), and easing trade tensions - last April’s ‘tariff tantrum’ seems like a distant memory.

Of course, banks aren’t known for their forecasting prowess – but for what it’s worth, Deutsche Bank is calling for a 17% gain in the S&P 500 this year. Most others are forecasting more modest returns of around 10%, broadly in line with the long-term average.

As a natural contrarian, this shift from doom to euphoria gives me pause. But ultimately, the lesson here is a familiar one: trying to predict short-term market movements is a fool’s errand.

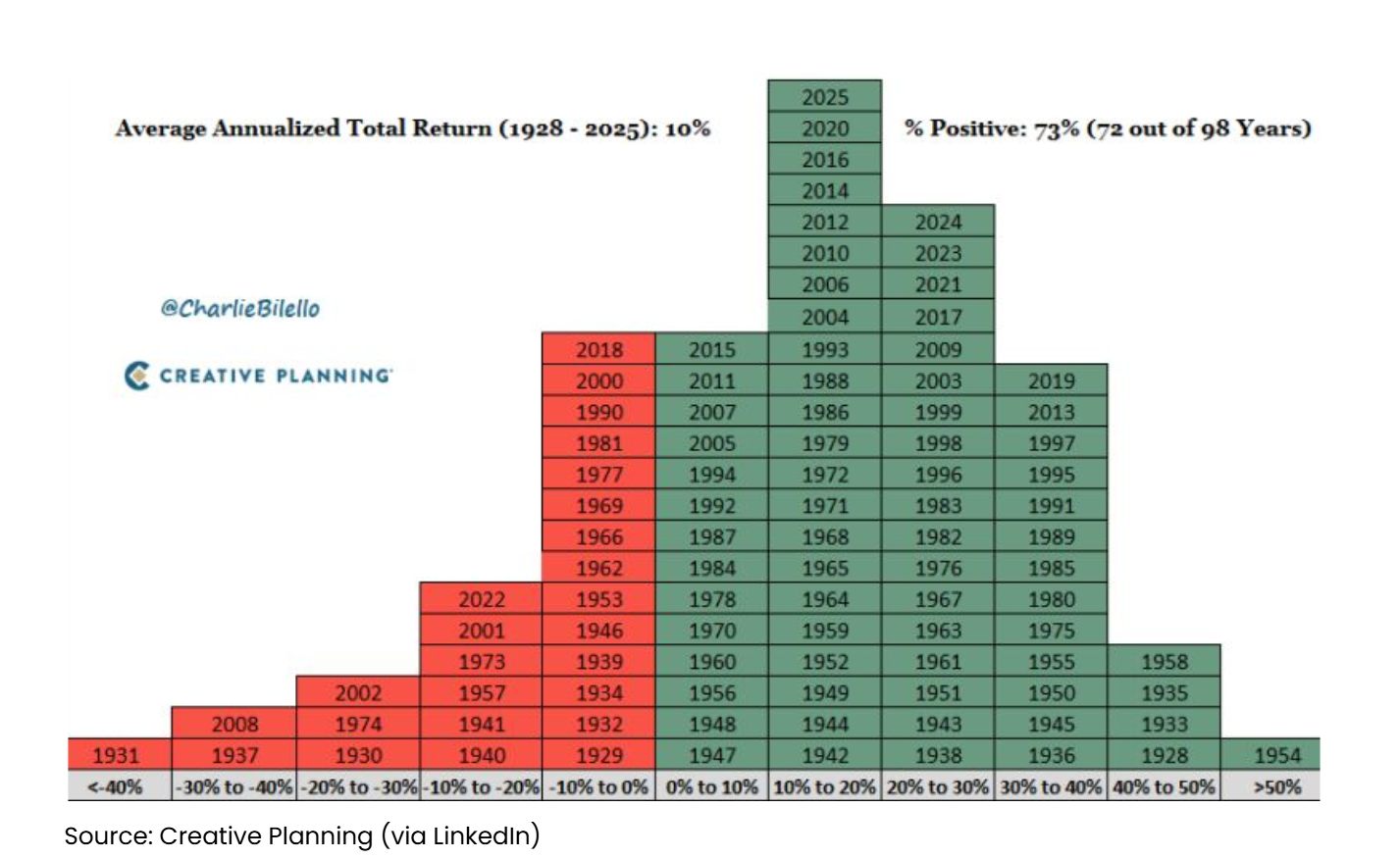

Which brings me to one of my favourite charts – a simple histogram showing the annual returns of the US stock market since 1928 (when daily performance data began).

What the chart tells us:

Positive returns dominate: In 72 of the past 98 years, the US market has delivered a positive return. That’s roughly 3 out of every 4 years.

Down years are the price of admission: The flip side is that one in four years is negative. But these drawdowns are the cost of entry for long-term growth. Without risk, there is no reward - or put another way, without the left side of this chart (downside) there would be no right side (upside).

Average returns are compelling: Over time, the average annual return has been 10%. With compounding (earning additional profit on past profit), that implies a doubling of your investment roughly every 8 years.

Volatility is part of the ride: Statistically, around 68% of years (one standard deviation) fall within a range of -8% to +32%, and 95% of years (two standard deviations) within -28% and +52%.

The downside ‘fat tails’: Sharp declines do occur. Since 1928, there have been 12 calendar years where the US market has fallen more than 10% – roughly once every eight years. Six of those saw declines of over 20% – about one in 18. And the most severe crashes, with losses exceeding 30%, have occurred three times: during the Great Depression and again in the Global Financial Crisis. These are rare, so-called ‘black swan’ events, but history shows they can and do happen, particularly over long investment timeframes.

This is just the US: We focus on the US market because it represents 60–70% of global equities by market capitalisation. But of course, our clients’ portfolios are globally diversified, with allocations to the UK, Europe, Asia, and beyond, plus bonds and cash.

The Key Takeaway?

Ignore the noise!

A new year brings the usual parade of predictions. Some will call for gains, others for crashes - most will be wrong.

We’ll stick with the same broken record our readers know well: staying invested remains the most reliable long-term strategy. Markets go up more often than they go down – typically three years out of four – with average annual returns of around 10%, punctuated by the occasional sharp correction.

This approach has worked for nearly a century, and we believe it will continue to work over the long run – fuelled by human innovation, a relentless drive to improve, and, to be frank, global capitalism, which rewards that innovation.

The stock market is a ‘get rich slowly’ machine, rewarding those who are patient, diversified, and resilient. Not those who try to time the tops and bottoms.

Happy Thursday!

Please note that when investing, your capital is at risk. The value of your investment (and any income from them) can go down as well as up, and you may get back less than you invested, particularly where investing for a short timeframe. Neither simulated nor actual past performance is a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Kind regards,

George

George Taylor, CFA

Referrals Welcome

Our business grows mainly through personal recommendations. If you know someone—whether a friend, family member or colleague—who might benefit from financial planning, we’d be grateful if you could share my details with them. Alternatively, you can pass their details on to me, and I’ll be happy to reach out.

Regulatory Information

Blincoe Financial Planning Limited is an appointed representative of Sense Network Ltd, which is authorised and regulated by the Financial Conduct Authority. Registered in England & Wales (No. 14569306). Registered Office: Star Lodge, Montpellier Drive, Cheltenham, GL50 1TY.

Important Disclaimer

This blog is for general information only and is intended for retail clients. It does not constitute financial or tax advice, nor is it an offer to buy or sell any specific investment. Since I don’t know your personal financial situation, you should not rely on this content as tailored advice. While we aim to provide accurate and up-to-date information, we cannot guarantee that all details remain correct over time. We are not responsible for any losses resulting from actions taken based on this blog’s content.