Autumn Statement 2025: Key Tax Changes Announced by Rachel Reeves and What They Mean for Your Financial Planning

A mixed bag for investors, savers and business owners

Yesterday, Chancellor Rachel Reeves delivered her second Autumn Statement. After the months of sensational headlines, the reality was more measured — with changes that were significant but largely gradual, modest, or deferred.

Below, we’ve highlighted the key announcements and some early thoughts on how they may impact tax planning strategies.

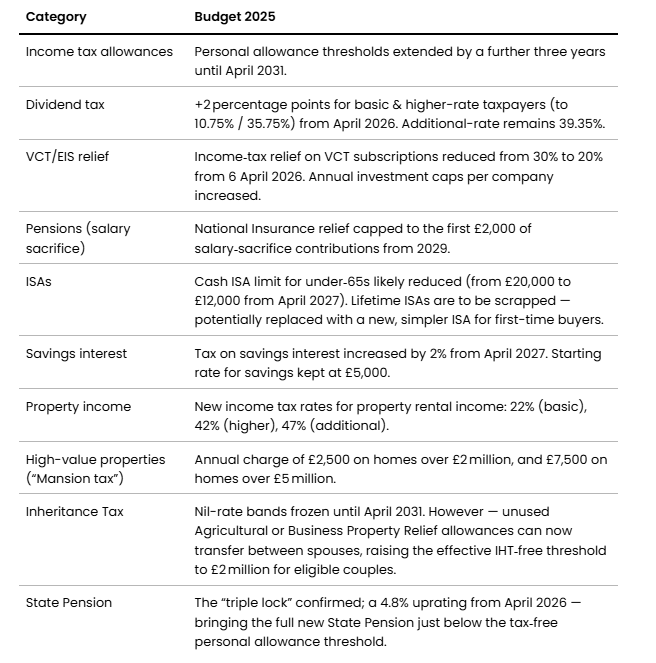

Key Changes Announced

Here’s a summary of the main changes to taxation:

Planning Implications

1. Stocks & Shares ISAs The Clear Winners

With cash ISA limits reduced and pensions facing diminishing incentives, the Stocks & Shares ISA was the relative winner in our view.

From April 2027, under-65s will be restricted to £12,000 in cash ISAs, but still able to invest £20,000 in Stocks & Shares ISAs.

ISAs continue to offer tax-free income and growth, with no restrictions on access.

Note, when investing, your capital is at risk. The value of your investment (and any income from them) can go down as well as up, and you may get back less than you invested.

2. Lifetime ISAs: On the Way Out

However, buried in the detail: LISAs are under review, with plans for a new, simplified ISA for first-time buyers.

Under current rules, LISAs allow 18–50-year-olds to invest up to £4,000 a year (within the £20k ISA allowance) and receive a 25% government bonus. Withdrawals are tax-free if used to buy a first home (up to £450k) or after age 60.

That latter point makes LISAs a valuable retirement top-up, particularly for higher earners limited by the tapered pension allowance. However, we suspect the new ISA will be aimed squarely at first-time buyers — in which case, that retirement incentive will likely disappear.

3. Pension Salary Sacrifice: A Blunt Change

From 2029, employee NI relief on salary sacrifice pension contributions will be capped at £2,000.

Here’s a practical example of what that means in cost terms:

Jack, an employee of ABC Ltd, earns a salary of £75,000 a year. His employer offers a relatively generous pension scheme:

Employee contributions (via salary sacrifice): 5% = £3,750

Employer contributions: 7.5% = £5,625. This is well above the auto-enrolment minimums (assuming the ‘total pay’ option, a combined 7% of pensionable pay, with a 3% employer minimum).

Under current rules, the entire £3,750 employee contribution avoids National Insurance.

Under the new rules, only the first £2,000 will remain NI-exempt. The remaining £1,750 will be subject to:

2% employee NIC = £35

15% employer NIC = £262.50

In isolation, these costs are modest. But scale that across a workforce, and employers may well look to trim contribution levels. In Jack’s case, ABC Ltd might reduce their employer contribution from 7.5% to 7% to offset the new charge.

Again, small in isolation but now scale that across an entire workforce and compound it over 20-30 years and the result will be a meaningful reduction in pension saving. And this comes at a time when the UK is already facing a well-documented retirement funding gap.

One important nuance: we understand National Insurance will still not apply to employer pension contributions. That means, for SME owners and company directors, employer contributions remain a very tax-efficient way to extract profit.

A pension is a long-term investment and funds are not normally accessible until 55 (rising to 57 from April 2028). When investing via a pension, your capital is at risk. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

4. Dividend Tax Hike - Modest for Investors, but Tougher on SMEs

From April 2026, dividend tax rates increase by 2% for basic and higher-rate taxpayers.

This is likely to have a modest impact on investors. As an example:

Take a £500,000 General Investment Account (GIA) with a typical 2% yield, implying £10,000 dividend income per year.

The proposed tax rise implies an additional £200/year.

This is unwelcome but modest — and unlikely to justify a change in strategy.

However, this increase will particularly affect SME owners and company directors.

A well-established remuneration strategy for business owners is to take a minimal salary — often around the personal allowance (£12,570) — to retain State Pension entitlement, and draw the rest of their income as dividends, which are taxed at lower rates than salary.

Example:

A couple who co-own and run their business each take:

A salary of £12,000, and

Dividends of £38,000 — keeping their total income just below the higher-rate threshold.

Under current rules (2025/26), this results in a combined dividend tax bill of £6,650 (2x £38,000 dividend income x 8.75% dividend tax).

From April 2026, the same setup will incur £8,170 in dividend tax — an increase of £1,520 per year.

This is more the realm of an accountant, but SME owners should revisit their remuneration approach — weighing up the trade-offs between salary, dividends, and employer pension contributions (which remain highly tax-efficient). Over time, these small changes can make a big difference to long-term wealth planning.

5. VCTs: Lower Relief, But Improved Investment Case?

Please note, VCTs are specialist investment vehicles and typically only suited to high net worth and experienced investors. VCTs typically invest in smaller companies that can have a higher failure rate and values can fluctuate more sharply than your mainstream investments. Furthermore, there may be difficulty in selling the investments and therefore may take some time to realise the investment. VCTs should be kept a minimum of five years to benefit from tax relief Tax rules and change along with the VCT qualifying status.

From April 2026, income tax relief on VCTs drops to 20% (from 30%). But the investment limit per investee company doubles — to £24m (or £40m for so-called ‘knowledge-intensive’ businesses).

This should allow VCTs to:

Back more mature businesses and

Provide follow-on funding to identified ‘winners’

We’ve written previously about how VCT returns follow a ‘power rule’, driven by a tiny handful of big winners.

For example, consider £50k invested equally across 50 companies. Over 5 years:

25 companies (50% of the portfolio) fail entirely

15 companies return 0%

5 double

3 return 5x

2 return 10x

In this basic example, that would result in a total investment value, by the end of the period, of £60,000 — a 20% cumulative return on the original £50,000 investment. Once the current 30% income tax relief is factored in, the effective return rises to 71%. That is despite half the portfolio going to zero and a further 30% flat-lining.

These figures are for illustrative purposes only and do not reflect actual investment returns, which can fluctuate and are not guaranteed.

Looking ahead under the new rules, the key question is whether the increased investment limits will allow VCTs to:

Back more mature, lower-risk businesses (thereby reducing failures), and

Deploy more capital into the small handful of standout performers that typically drive overall returns.

If so, this could help offset the reduction in upfront tax relief — but it’s not guaranteed. Time will tell whether the potential for improved returns outweighs the cut in income tax relief from 30% to 20%.

6. IHT Planning: More Relevant Than Ever

Nil-rate bands are frozen until 2031 (a one-year extension), which means more families will be dragged into the IHT net. The government expects IHT receipts to exceed £14bn/year vs c. £8bn for the most recent period.

However, one silver lining - the government confirmed that Agricultural and Business Property Relief is now transferable between spouses. For couples with qualifying assets, this creates an effective £2m IHT-free threshold.

Final Thoughts

This Autumn Statement wasn’t as severe as some had feared. While the Chancellor delivered a range of tax-raising measures, these were mostly incremental, delayed, or delivered through frozen thresholds rather than major policy shifts.

Even so, the cumulative effect could be significant over time — reinforcing the importance of:

Diversifying across different tax-efficient wrappers

Diversifying income streams, and

Keeping financial plans under regular review.

If you’re unsure how the changes may affect you, we’re here to help.

Happy Thursday!

Kind regards,

George

George Taylor, CFA

Referrals Welcome

Our business grows mainly through personal recommendations. If you know someone—whether a friend, family member or colleague—who might benefit from financial planning, we’d be grateful if you could share my details with them. Alternatively, you can pass their details on to me, and I’ll be happy to reach out.

Regulatory Information

Blincoe Financial Planning Limited is an appointed representative of Sense Network Ltd, which is authorised and regulated by the Financial Conduct Authority. Registered in England & Wales (No. 14569306). Registered Office: Star Lodge, Montpellier Drive, Cheltenham, GL50 1TY.

Important Disclaimer

This blog is for general information only and is intended for retail clients. It does not constitute financial or tax advice, nor is it an offer to buy or sell any specific investment. Since I don’t know your personal financial situation, you should not rely on this content as tailored advice. While we aim to provide accurate and up-to-date information, we cannot guarantee that all details remain correct over time. We are not responsible for any losses resulting from actions taken based on this blog’s content.