The Blincoe Blog

We write in plain English - no jargon, no waffle - just useful ideas to help you take control of your money, plan ahead, and make smarter decisions.

🔍 Looking for something specific? Use the search tool below.

“An investment in knowledge always pays the best interest.”

- Benjamin Franklin

Tax Year-End Planning 2025/26: Five Key Actions Before 5 April and Major Tax Changes From April 2026

With the tax year ending on 5 April, now is the time to review allowances, use available reliefs, and prepare for significant tax changes ahead.

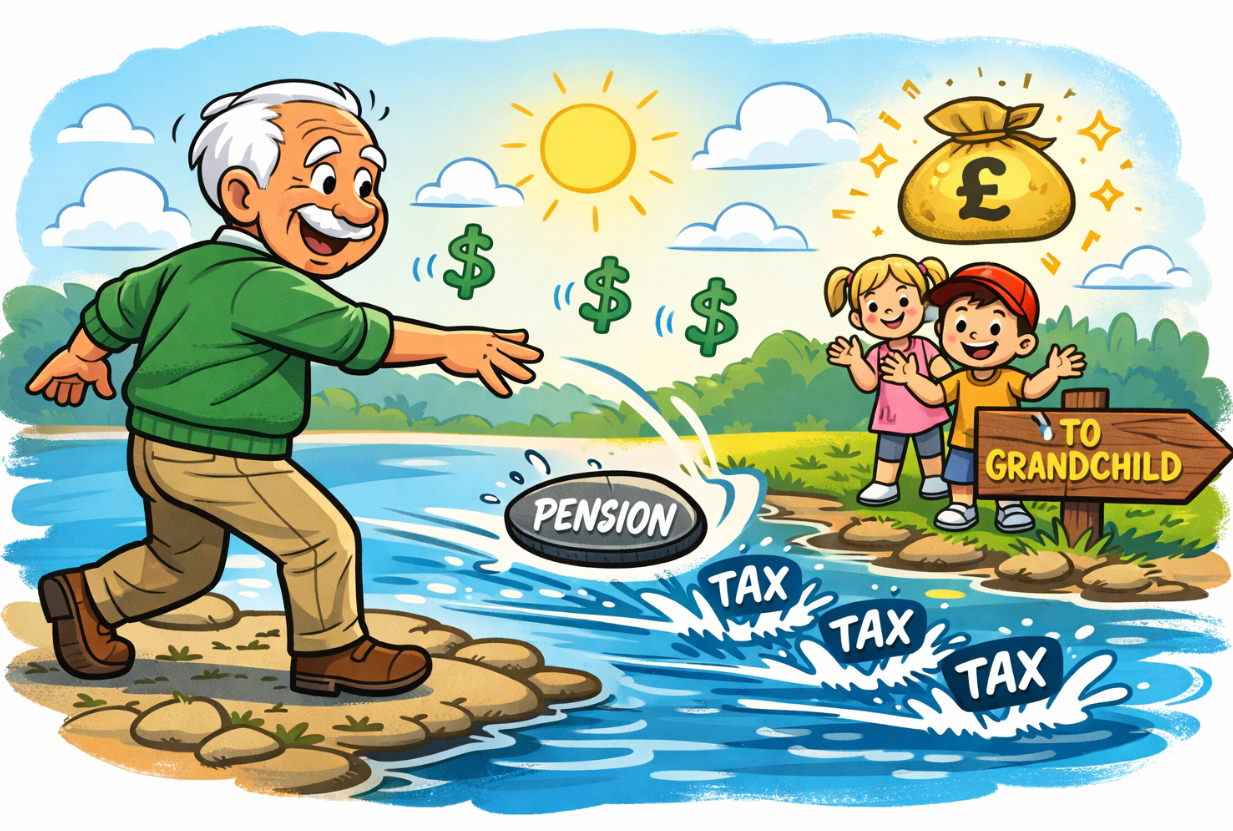

Leaving Your Pension to Grandchildren: How Generation Skipping Can Reduce Tax on Inherited Pensions

Leaving pension wealth to grandchildren, rather than children, can significantly reduce income tax on inherited pensions - especially once withdrawals become taxable after age 75.

Running 26.2 Miles for a Great Cause (and a Good Tax Break)

George is running the London Marathon for Sue Ryder! We explore how charitable giving can support a great cause while delivering meaningful tax planning benefits.

Understanding ISAs in 2026: Types, Rules, Allowances and How to Use Them Tax-Efficiently

ISAs remain one of the most powerful tax-efficient tools for UK savers. This week, we revisit the rules, options, and how to use your allowance effectively.

Autumn Statement 2025: Key Tax Changes Announced by Rachel Reeves and What They Mean for Your Financial Planning

After months of speculation, the Autumn Statement delivered fewer shocks than expected, but introduced a series of gradual tax changes that will shape planning decisions over the coming years.

Autumn Statement 2025: Likely Changes to Income Tax, Pensions, CGT, IHT and Property Taxes

Budget rumours are everywhere, but which ones matter? With the Autumn Statement days away, we outline the changes most likely to make the final cut.

How Loan Trusts Work: A Practical Guide to Inheritance Tax Planning With Access to Capital

Looking to reduce inheritance tax without losing control of your money? A Loan Trust could offer the right balance of access and efficiency.

If I Were Chancellor for a Day…

With the Autumn Statement weeks away, we have played Chancellor for a day — exploring tough but realistic ways to restore stability and strengthen UK finances

Childcare Costs and the £100k Cliff Edge: How Pension Planning Can Save Thousands

Discover how the latest childcare support can save your family thousands, and how smart pension planning can ensure you don't miss out.

From Pensions to ISAs: 10 Overlooked Tax Mistakes That Could Cost You Thousands

This is the third in our trilogy exploring some of the most common pitfalls we encounter in financial planning, today's focus turns to tax. We look at 10 common mistakes and how to avoid costly errors.

Are General Investment Accounts Still Worth It? Tax Changes, Strategies, and Pension Pairing Explained

The once-popular General Investment Account (GIA) has come under pressure in recent years. While GIAs have lost some shine, they’re far from redundant. For many clients, the ability to blend them with pension contributions to preserve basic rate treatment keeps them firmly in the financial planning toolkit.

Autumn Statement Preview: 7 Tax Changes We Might See (and How Likely They Are)

The Autumn Statement looms and the usual crystal ball gazing and Westminster whispers have already begun. In this weeks blog we look at what might be coming – rumours, reality, and red herrings.

Will Your Pension Be Taxed Twice? What the 2027 ‘Double Death Tax’ Means for Families

From April 2027, pension funds will no longer be exempt from Inheritance Tax – and in many cases, could be taxed twice: IHT on death, then income tax on withdrawal. For some, the combined hit could exceed 60%. However, there are steps that can help reduce or even avoid the so-called Double Death Tax.

Smart Cash Management: 4 Tax-Efficient Strategies to Maximise Your Savings

Whether it’s restructuring accounts between spouses, using cash savings platforms to secure best-in-market rates, or taking advantage of tax-free returns via Premium Bonds or UK Gilts, the right strategy can materially improve after-tax outcomes—often with minimal effort and no increase in risk.

Tax-Efficient Ways to Extract Profits from Your Company: Salary, Dividends, Pensions & More

What’s the most tax-efficient way to take money out of your company? There’s no one-size-fits-all answer, but this blog explores proven strategies to help you extract profits smartly and sustainably.

How to Use Bed & ISA and Bed & Pension Strategies to Maximise Tax Relief

The recent outbreak of trade tensions has sent global markets into a tailspin. Amidst this volatility lies opportunity, a new tax year offers fresh ISA and pension allowances—an ideal time to make strategic moves that enhance your tax efficiency.

Are Offshore Investment Bonds the Hidden Gem of Tax Planning?

These products were once overlooked – often dismissed as expensive and inflexible. But they’ve come a long way. Today, they offer a range of tax planning benefits and can sit neatly alongside pensions, ISAs and general investment accounts (GIAs) as part of a well-structured financial plan.

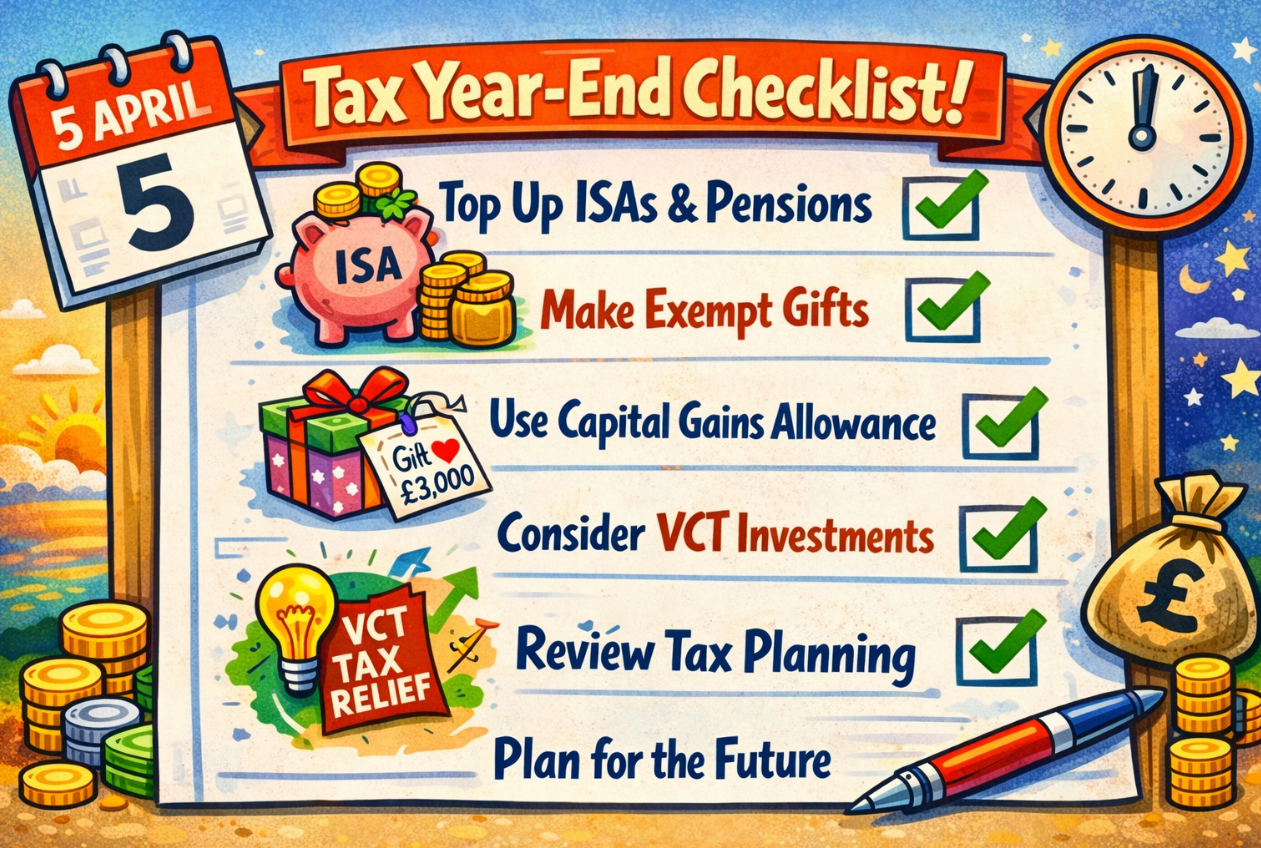

Your 2025 Tax Year-End Checklist: Five Smart Moves Before April 5th

Investment gains have increased from 10% to 18% for basic-rate taxpayers and from 20% to 24% for higher-rate taxpayers. Now is the time to make the most of available allowances, reliefs, and exemptions.

Avoid the £100,000 Childcare Trap: Pension Planning for Young Families

Many parents face a costly tax trap when their income exceeds £100,000, causing them to lose valuable childcare benefits.

Autumn Budget 2024 Opportunities: How to Pivot Your Tax and Investment Strategy

As one door closes, another one opens.