Understanding ISAs in 2026: Types, Rules, Allowances and How to Use Them Tax-Efficiently

Everything you need to know about ISAs in 2026

Individual Savings Accounts (ISAs) remain one of the most effective ways for UK savers and investors to grow their wealth tax-efficiently. In this week’s blog, we’re going back to first principles, providing an overview of the current ISA landscape and answering some of the most common questions we receive from clients.

We’ll cover the different types of ISA, the rules that apply, proposed changes on the horizon, and how best to make use of your allowances.

Part 1: The ISA Product Range

Cash ISAs

Cash ISAs function like standard savings accounts but with one crucial difference: the interest you earn is completely tax-free.

You can open a Cash ISA if you’re a UK resident aged 18 or over, and contribute up to £20,000 per tax year across all your ISAs combined. These are available from banks, building societies, and other providers, with a choice between easy-access, notice-period, and fixed-term options.

Stocks & Shares ISAs

These allow you to invest in a range of assets, including individual shares, bonds, investment funds, and exchange-traded funds (ETFs), all whilst sheltering any growth and income from UK tax. The same £20,000 annual allowance applies, shared with your other ISA subscriptions.

Anyone aged 18 or over who is a UK resident can open a stocks and shares ISA. The key difference from cash ISAs is that your capital is at risk, but historically, investments have delivered superior long-term returns compared to cash savings.

When investing, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invested, particularly where investing for a short timeframe (we usually recommend a horizon of at least 5 years). Neither simulated nor actual past performance is a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Lifetime ISAs (LISAs)

The Lifetime ISA is designed to help people save for their first home or retirement. You can save up to £4,000 per tax year (which counts towards your overall £20,000 ISA allowance), and the government adds a 25% bonus on contributions, typically credited within 6-10 weeks.

Available to those aged 18-39, you can continue contributing until age 50. The funds can be withdrawn penalty-free to purchase a first home worth up to £450,000, or from age 60 for retirement. Withdrawals for any other reason incur a 25% charge, which effectively claws back the bonus plus a portion of your own contributions - effectively, a 6.25% penalty.

Junior ISAs (JISAs)

Designed for children under 18, Junior ISAs come in both cash and stocks and shares varieties. Parents, guardians, or indeed anyone can contribute up to £9,000 per child per tax year.

Only parents or those with parental responsibility can open a JISA, though anyone can contribute once it's established. The child cannot access the money until they turn 18, at which point the account automatically converts to an adult ISA under their control.

Part 2: Pros & Cons

Advantages of ISAs

The tax efficiency is the standout benefit. All growth, income, and gains within an ISA are free from income tax and capital gains tax. ISAs have been the key winner of the last few budgets. With capital gains tax allowances gradually reduced from £12,300 to just £3,000, and income tax on dividends due to increase, sheltering investments within ISA wrappers becomes all the more important.

Flexibility is another strength. Unlike pensions, you can access your ISA funds at any time without penalty (except for LISAs in certain circumstances). This makes ISAs ideal for medium to long-term goals that might arise before retirement age.

The range of products means there's likely an ISA suited to your circumstances, whether you need the security of cash or are comfortable with investment risk for potentially higher returns.

Disadvantages of ISAs

The annual allowance, whilst generous for many, does impose limits on how much you can shelter from tax each year. For higher earners with substantial savings capacity, this can feel restrictive. The ISA allowance is due to remain frozen at £20,000 until 2031, having been set at this level in 2017. That's another case of fiscal drag. Had it been inflation-linked, it would stand at around £27,500 today.

ISAs don't benefit from the upfront tax relief that pensions enjoy. When you contribute to a pension, you receive tax relief at your marginal rate, whereas ISA contributions are made from taxed income. Generally speaking, this makes pensions significantly more powerful for wealth accumulation, especially those paying income tax at the higher rates.

For Lifetime ISAs specifically, the restrictions and penalties for early withdrawal can be punitive if your circumstances change, making them less flexible than standard ISAs.

Part 3: Frequently Asked Questions

New Cash ISA Rules

What are these new cash ISA rules limiting savings to £12,000?

From April 2027, the government will introduce a £12,000 cap on new subscriptions to cash ISAs for savers under age 65, though your overall ISA allowance remains £20,000. This means if you're under 65, you'll still be able to save the full £20,000, but a minimum of £8,000 must go into stocks and shares ISAs if you want to use your full allowance.

Those aged 65 and over will be exempt from this restriction and can continue to use their full £20,000 allowance for cash ISAs if they wish.

The policy is designed to nudge younger savers towards investing rather than holding everything in cash, recognising that cash has historically underperformed investments over longer timeframes, whilst acknowledging that older savers may have different risk appetites and shorter time horizons.

Existing cash ISA balances above £12,000 are protected; the limit only applies to new money added from April 2027 onwards.

However, there's uncertainty around a potential workaround involving stocks and shares ISAs that hold cash-like money market funds, which could effectively function as cash whilst technically meeting the investment requirement. We'll be watching closely to see how providers and regulators address this. There’s been some discussion about a fine applying to such holdings but that would be difficult to monitor or administer in practice.

ISAs vs Pensions

Which is better?

For most people, pensions win in terms of wealth creation thanks to the ‘triple whammy’ of:

Tax relief on contributions at your marginal rate of income tax

Tax-free growth within the pension, and

The ability to take 25% of your fund tax-free at retirement (up to the Lump-Sum Allowance, currently set at £268,275).

A basic-rate taxpayer contributing £80 to a pension sees it topped up to £100 through tax relief. A higher-rate taxpayer can claim additional relief, making their effective contribution just £60 for every £100 in their pension. This is a powerful benefit that ISAs simply cannot match.

We’ve written about this superior tax efficiency in a recent blog - click here.

But the trade-off is accessibility. Pension funds cannot be touched until the Minimum Pension Age (currently 55, rising to 57 in 2028), whereas ISAs can be accessed at any point.

For most of our clients, a blend of both is the optimal strategy, mixing tax efficiency with accessibility. Ideally, you'll reach retirement with material savings in both pensions and ISAs. This gives us valuable levers to pull when structuring retirement income in a tax-efficient manner. For example, we might take taxable pension income up to the higher-rate threshold (£50,270) then top up with tax-free ISA withdrawals, keeping you in the basic-rate band and maximising your after-tax income.

Pending LISA Review

What is happening to Lifetime ISAs?

The Autumn Statement 2025 confirmed that the government will launch a review of Lifetime ISAs early this year, with a view to potentially scrapping them and introducing a simpler ISA product focused on helping first-time buyers.

This is presumably intended to discourage people from using LISAs as ‘retirement top-up plans’ and refocus the product on its original purpose. As part of this overhaul, there are strong rumours that the government will lift the £450,000 house purchase limit, which has become increasingly restrictive in many parts of the country.

For existing LISA holders currently playing the ‘age 60 game’, we suspect these accounts will be frozen. Our expectation is that bonuses already accumulated will be retained, but the option to make further contributions may be removed. However, this is policy speculation at this stage - we'll report back once the review concludes and firm proposals emerge.

Cash ISA vs Stocks & Shares

Which should you choose?

This is perhaps the most common ISA question we encounter. The UK does have something of an obsession with cash ISAs and cash savings more broadly.

Statistics published by HMRC in September 2025 show that in the 2023/24 tax year, a total £103 billion was subscribed to Adult ISAs, of which £69.5 billion or 67% (!!) was added to Cash ISAs [Source: Gov.Uk].

Cash ISAs certainly have their place. We favour cash for emergency funds and for major spending needs over the next two to three years. The security and accessibility make cash the right choice for short-term goals.

However, for longer-term objectives, investing offers the path to superior inflation-beating growth. The usual disclaimer applies that past performance is no guarantee of future returns, but historical data demonstrates the advantage.

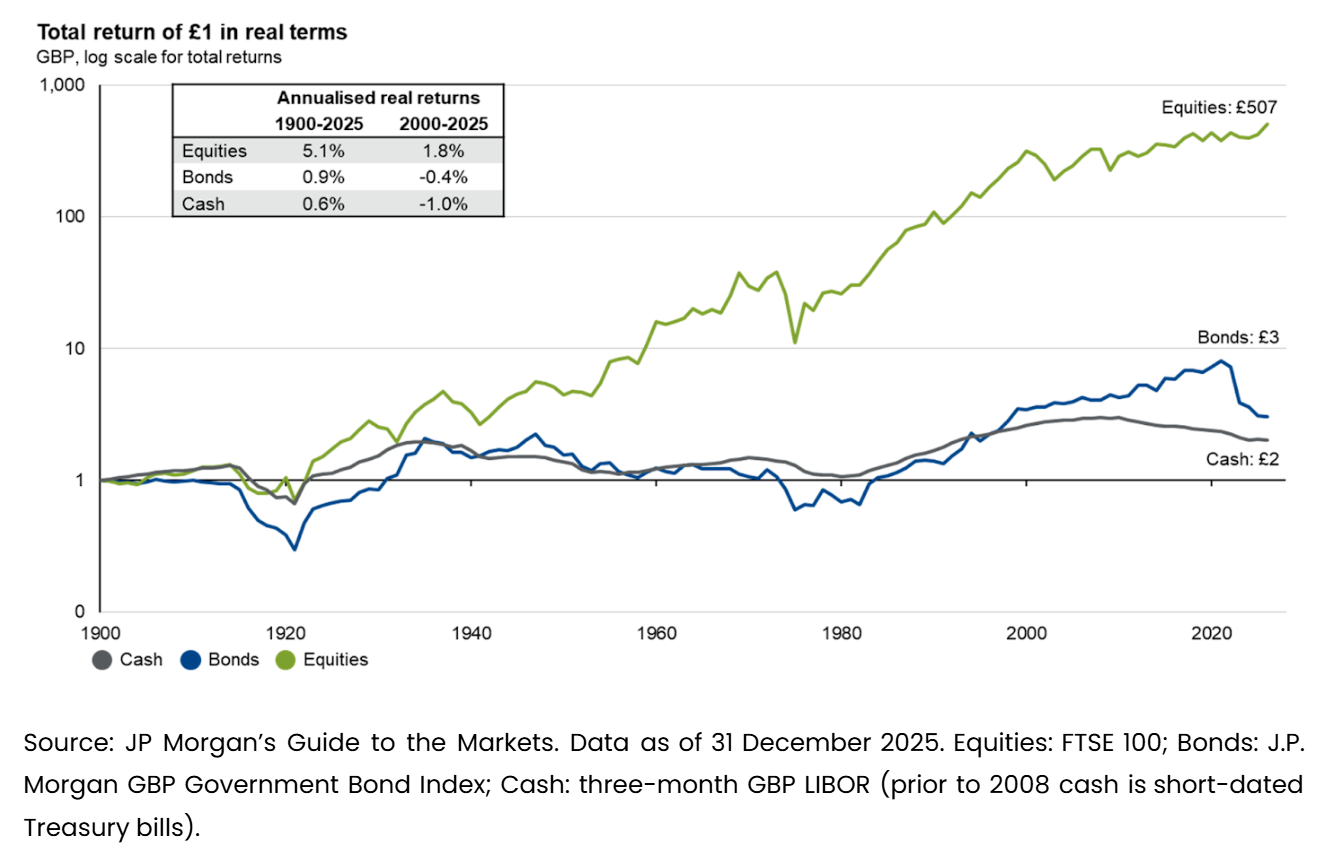

The chart below illustrates the stark difference in long-term returns between equities and cash. Equities, as measured by the FTSE 100 Index, have delivered average real returns (after inflation) of 5% per year between 1900 and 2025. Whilst there have inevitably been periods of volatility along the way, the asset class has consistently outpaced inflation over the long term.

In contrast, cash (measured by 3-month LIBOR rates) has delivered only a 0.6% long-term real return over the same period. More concerningly, since the turn of the millennium, cash has actually delivered a -1.0% per year inflation-adjusted loss, meaning savers holding cash have seen their purchasing power steadily eroded.

This data underscores why holding substantial long-term savings in cash can be costly, particularly in an environment where inflation remains persistent.

Investing isn't for everyone. Investment carries risk - it has to, otherwise returns would be risk-free and match those available from cash. But that risk presents opportunity and helps counter the insidious risk that inflation will erode the real purchasing power of your savings over time.

It also follows that, generally speaking, it's better to hold investments inside an ISA wrapper rather than cash. Since ISA returns are tax-free, you want to hold the higher-performing asset class inside the ISA wrapper to make better use of that tax-free status.

The JISA to ISA Conversion

What happens when my child turns 18?

This is a conversation I have regularly with clients saving for their children, and it centres on a key trade-off.

JISAs are exceptionally tax-efficient. You can save up to £9,000 per child per tax year until they reach 18, with all growth completely tax-free. Assuming 6% compound annual growth and maxing out contributions each year from birth, that could result in a pot worth approximately £280,000 by the child's 18th birthday (or c. £180,000 in today’s price terms, factoring in inflation at 2.5%).

Please note, these figures are for illustrative purposes only and do not reflect actual investment returns, which can fluctuate and are not guaranteed.

At that point, the JISA automatically converts to a standard adult ISA. The child will typically be informed by the provider, who will need to carry out verification checks. The crucial point is that the child then has full legal access to all the money. Completely tax-free.

Whether that's appropriate, and whether you're comfortable with an 18-year-old having access to such a substantial sum, is a personal decision that only you as the parent or guardian can make.

That said, one approach we often recommend to clients is getting the child involved in the ISA from around age 15-16. Setting out that the pot exists but is earmarked for a specific purpose, such as university costs, house deposit, or another meaningful goal, provides a strong foundation.

Another strategy we've seen work well is to transfer a small portion, perhaps 5-10% of the funds, into a separate account for the child to manage themselves. This hands-on experience can be invaluable in developing strong investment habits and financial literacy—lessons that, quite frankly, aren't being taught adequately in schools or universities. It gives them a stake in the decision-making process whilst keeping the majority of the funds protected for their intended purpose.

Summary

ISAs remain a cornerstone of tax-efficient financial planning. Whether you opt for the security of cash or the growth potential of investments, understanding the rules and using your allowances wisely can make a meaningful difference to your long-term financial outcomes.

As always, if you'd like to discuss how ISAs fit into your broader financial plan, please don't hesitate to get in touch.

Happy Thursday!

Please note that when investing, your capital is at risk. The value of your investment (and any income from them) can go down as well as up, and you may get back less than you invested, particularly where investing for a short timeframe. Neither simulated nor actual past performance is a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Kind regards,

George

George Taylor, CFA

Referrals Welcome

Our business grows mainly through personal recommendations. If you know someone—whether a friend, family member or colleague—who might benefit from financial planning, we’d be grateful if you could share my details with them. Alternatively, you can pass their details on to me, and I’ll be happy to reach out.

Regulatory Information

Blincoe Financial Planning Limited is an appointed representative of Sense Network Ltd, which is authorised and regulated by the Financial Conduct Authority. Registered in England & Wales (No. 14569306). Registered Office: Star Lodge, Montpellier Drive, Cheltenham, GL50 1TY.

Important Disclaimer

This blog is for general information only and is intended for retail clients. It does not constitute financial or tax advice, nor is it an offer to buy or sell any specific investment. Since I don’t know your personal financial situation, you should not rely on this content as tailored advice. While we aim to provide accurate and up-to-date information, we cannot guarantee that all details remain correct over time. We are not responsible for any losses resulting from actions taken based on this blog’s content.